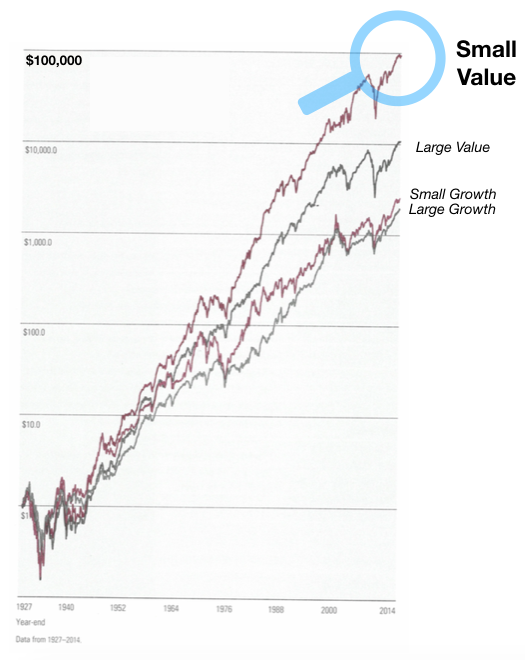

Small Cap Value Charts

Note: These 3 charts are logarithmic. The distance between each line represents the same percentage change. Put another way, a true rate of change in value is seen.

Chart 1. Cumulative Returns of Large-Caps vs Small-Caps (1928-2004)

This is the chart that turned me on to Small-cap Value. It’s actually the same data as chart 2, but ends 11 years earlier.

$1 Small-cap Value @ 76 years = $43,600

$1 Large-cap Value @ 76 years = $5,642

$1 Small-cap Growth @ 76 years = $1,173

$1 Large-cap Growth @ 76 years = $859

Courtesy of Morningstar

Chart 2. Cumulative Returns of Large and Small-Cap Value and Growth Stocks (Y/E 1927 - Y/E 2014)

Summary Statistics of Annual Returns, Geometric Mean Returns:

Large Growth Stocks: 9.1%

Large Value Stocks: 11.3%

Small Growth Stocks: 9.4%

Small Value Stocks: 14.1%

$1 Small-cap Value @ 87 years = $94,173

$1 Large-cap Value @ 87 years = $10,781

$1 Small-cap Growth @ 87 years = $2,556

$1 Large-cap Growth @ 87 years = $1,937

Courtesy of Morningstar

What is most important about this chart? I know what you’re thinking, but sorry, it’s not the 14.1% annualized return of Small-cap value over the past 87 years. I, like everyone else in the world, cannot predict the future returns of Small-cap Value stocks.

Most important here is the remarkable superior performance of Small-cap Value over the other 3 stock classes for almost 90 years. And the persistence of SCV outperformance ─ the fact that it has endured ─ is confirmed by the ever-widening gap between SCV and the other three stock classes on this logarithmic chart. I can’t tell you what your exact returns will be, but there are 87 good reasons to believe this near-century-long SCV superiority will continue.

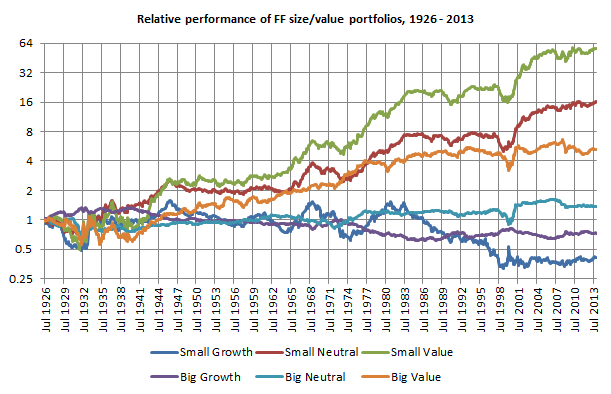

Chart 3. Relative Performance of Fama/French Size/Value Portfolios, 1926-2013

This logarithmic chart is very important. It shows the rates of change between 6 different stock groups. The takeaway: Small-cap value continues to widen its spread over the other stock groups, which proves it continues to outperform.

Courtesy of Kevin Wrotenbery, SeekingAlpha, 2/20/2014 (Link)